Quote by sprinter

I am trying to put together a detailed list of what is actually required to Import a motorhome. or Campervan, to the ROI. in the last six months or so, I'm looking for an update on the procedure and costs,? I would like actual figures. Also if anyone has done it the other way round, from ROI. I can put that together as well.

No 1. anyone imported a second hand Motorhome from the UK into the ROI.?

No 2. anyone importing one From NI, with a UK reg, to the ROI.?

No 3. anyone Imported one from NI, with an NI reg ?

No 4. imported a new one of either, without UK or Ni plates.?

I understand some won't want to publish details on an open Forum, so please PM me and I can get the details that way.

I don't want a list of Government web sites, I'm fed up with websites saying one thing ,and then people dealing with it ,having completely different guidelines,

Second hand import UK

Customs duty of 10% of the receipt/invoice. If it’s a private sale, bank transfer record. It’s also supposed to include costs of insurance/transport so need ferry booking and receipt.

On this new figure, 23% Vat is added.

To do all this book ferry, make payment, and hire a customs agent (customs won’t deal with joe public) if you can get one to do it (when ringing around say car initially). They do all the import forms and email them to you, you need the ref numbers. Pay for services of said customs agent, varies by agent but budget roughly €150

On arrival in the country make yourself known to customs, quote ref numbers (and any extra alcohol/tobacco on board

). If it’s clear, drive on. If not, off to the customs office.

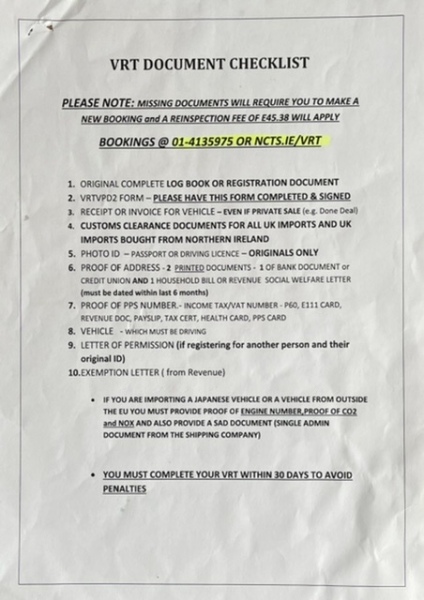

Then to VRT. Book appointment within 7 days of arrival at NCT centre (not all of them do it). At appointment they inspect the vehicle and will want to see the VIN number where it is stamped into the chassis (labels/plates on front cross member over radiator will not suffice). Photos taken and sent off to Revenue.

They will send their assessment of what VRT is owed by text or email. NCT guy said up to 5 working days before they get back. I was told today it could be up to fifteen working days.

When the bad news arrives, back to NCT centre to pony up.

Get registration number, and have new plates on the motor within three days, some NCT centres can make plates.

You have 30 days from arrival to complete the above.

Searching for instructions online is maddening. I called to NCT centre and spoke to VRT guy who was very helpful. Also spoke to revenue on the phone, also helpful.

Vintage is 30 years old and applies to motorhomes, €200 for VrT, other taxes levied duties whatever still apply.

UK MOT is not transferable to CVRT.

Vehicle must be weighed at an official weighbridge and cert will be provided.

Next is get the vehicle passed the CVRT.

Road tax cannot be done online. Form RF100 must be filled in, and brought to a motor tax office with the CVRT and weight certs.

). If it’s clear, drive on. If not, off to the customs office.

). If it’s clear, drive on. If not, off to the customs office.